Taiwan

(1) Current Status of the Water Purifiers Industry in Taiwan

The water purifiers industry in Taiwan began in the 1970s and has experienced rapid growth since the 1990s. In its early stages, the industry concentrated on processing and assembly activities in the midstream. Nearly fifty years later, the industry continues to focus on materials and components in the upstream, and on sales and services in the downstream. Currently, there are approximately 300 companies in Taiwan forming a comprehensive supply chain. Of these, 25% are involved in material manufacturing and trading in the upstream, 25% in assembly activities in the midstream, and the remaining 50% in sales and distribution in the downstream.

(2) Complete Supply Chain in Taiwan

The water purification equipment industry in Taiwan encompasses all value chain activities, from upstream and midstream to downstream. It is equipped with core expertise in filtering technology, R&D and innovation, industrial design, production and assembly, quality control, OEM/ODM, and sales and distribution.

(3) Continued Growth in Taiwan’s Export of Water Purification Equipment

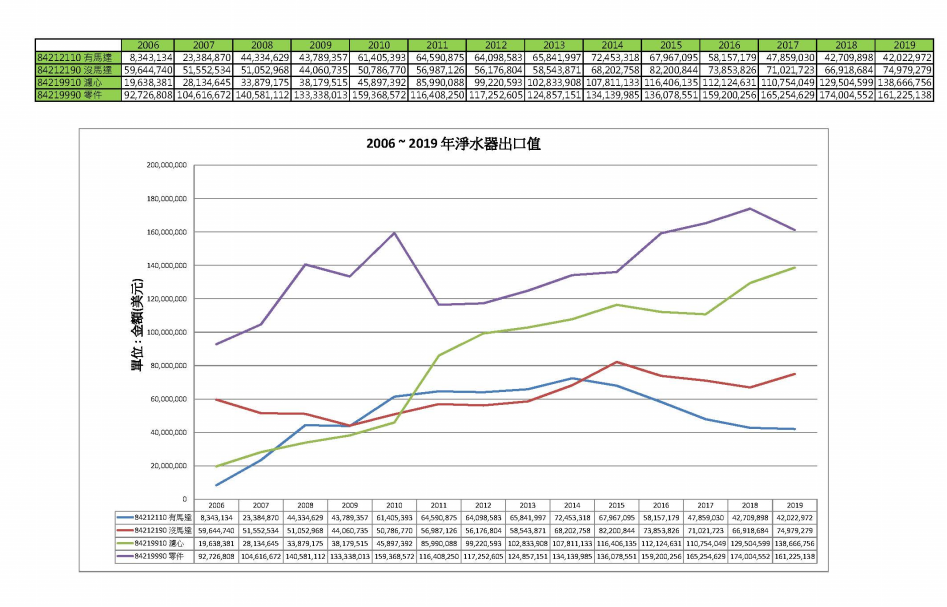

The export value of water purification equipment increased from US$180 million in 2006 to US$417 million in 2019, marking a growth of 2.32 times over a period of 13 years. These figures highlight the competitiveness and potential of water purification equipment for home use manufactured in Taiwan.

Below is a list of data for the water purifiers market.

Taiwan is the best option for outsourcing partnerships when it comes to home-use water purifiers. The water purification equipment industry holds unlimited potential. Global competition will only intensify.

Source: Import/export statistics from the Bureau of Foreign Trade of the Ministry of Economic Affairs

(4) Abundance of Basic Materials for Water Purification Equipment

Taiwan’s expertise in performance textiles provides high-quality, competitively priced filters for water purification. Taiwan’s strengths in smart panels and electronic engineering are crucial for enhancing home-use water purifiers.

In the 1990s, many industries in Taiwan relocated to China to establish production facilities, and the water purifiers industry was no exception. This includes companies such as Multiply, Kemflo, KSW (King Sky Water), Hantech, ACUO, and Deng Yuan.

Following the trade frictions between China and the U.S. during the Trump administration, manufacturers doing business with the U.S. have been expediting their exit from China to avoid punitive tariffs and declining competitiveness. Per capita income in China has risen from $900 to over $9,000 in the past two decades, and manufacturing costs have also increased. Consequently, Taiwanese water purification equipment manufacturers are either returning to Taiwan or relocating to Southeast Asia.

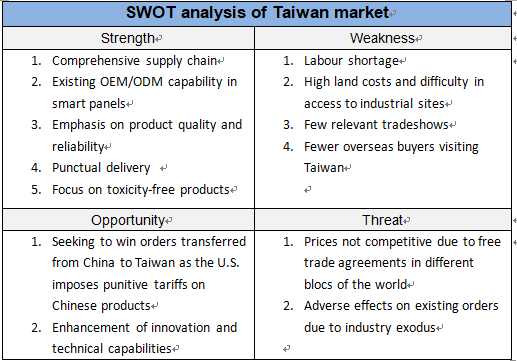

(5) SWOT Analysis of the Taiwanese Market for Water Purification Equipment

(6) Forecast for the Water Purification Equipment Market in Taiwan

The issue of lead water pipes in October 2015 raised concerns about water safety. Additionally, food safety problems emerged one after another. Consequently, the market size in Taiwan reached NT$2.85 billion in 2016, representing a dramatic increase of 21% from 2015.

It is anticipated that more than 87,000 under-sink filters will be sold during the year, with the market size totalling US$4.5 million.

(7) Electronics Heavyweights Eye the High Growth of the Water Purification Market

It appears that everyone in Taiwan recognises the potential of the water purifiers market. Many listed companies are joining the trend by investing heavily in the development of filter materials, the design of complete units, research into LED UV disinfectant lamps, and functional water materials. Marketers are also seeking manufacturers for outsourced production.

Some of the major players are as follows:

- NKFG Corporation (a member of the Formosa Plastics Group)

- Innolux

- OPPOTECH

- Micro-Star International

- AU Optronics Corporation

(8) Key issues for selling home-use water purifiers in Taiwan

1.About Investing in Production Facilities

The profit margin is declining in home-use water purifiers in Taiwan. The domestic market is simply limited. Although the supply chain is comprehensive, most companies rely on exports for over 90% of their business. Meanwhile, there is a shortage of factory operators, the cost of land is high, and environmental protection laws and regulations are becoming increasingly stringent. Investing in production facilities in Taiwan at this point in time does not appear to be a prudent decision.

2. Advice for New Brands Entering the Market

There is a long list of brands in the water purifiers market in Taiwan. The advertisements of well-known international brands are everywhere. Taiwanese consumers are receptive to high-quality, slightly more expensive products from abroad.

Foreign Brands:

3M, Everpure, AO Smith, BWT, Coway, Brita, Doulton, Philips, Panasonic, Toray, Amway, Mitsubishi, Franke, Pureit, Laica, LG, GE, Honeywell, Lux, Watpure, Toppuror, Xiaomi

Although the competition continues to intensify, it is not yet too late for new entrants to enter the Taiwanese market with differentiated products, correct positioning, and precise marketing strategies.

Domestic Brands (with their own factories, channels, and brands):

ALYA, CHANSON, Water Nice, ACUO, Great Idea, Yen Sun Technology, Sakura, Buder, Hao Hsing

The content of this article is free to use, but please attribute the source.

Author: Rodger Lin, Easywell Water Systems Inc.

For more information, please visit https://ppt.cc/fzKJ2x

Korea

(1) Snapshot of the water purifiers market in Korea

Before 1997, the water purifiers market in Korea was dominated by multilevel direct sellers. The momentum for continued growth was underpinned by a vibrant leasing market.

There are over 100 manufacturers of components and complete units of water purifiers in Korea. These companies are capable of developing new products and they share information, so that they can develop products with interchangeable parts/components.

(2) Leasing market still hopeful in Korea

There are two changes in the water purifiers market of Korea: (1) large water dispensers gradually becoming compact, with filtering functions; (2) leasing market continuing to grow.

(3) Functional water purifiers popular in Korea

Koreans wanted to have clean and safe water. Now they pursue functional water that is beneficial to health. To meet this demand, companies are starting to produce water purifiers that provide carbonated water, pure water for coffee making, hydrogen water, alkali ion water, and energy water.

The Korean market for water purifiers is dominated by UF (ultra-filtration) products, accounting for 55% of the market. Most of this 55% is sold via leasing. RO products have the remaining 45% market share.

The filtering method is gradually shifting from four to five filters to two to three filters, as filtering functions are integrated.

The Korean government authorises the Korea Water Purifier Industry Cooperative (KOWPIC) as the regulator for the market by conducting quality inspections and conferring quality certifications to water purification products.

(4) Development of functional water filters in Korea

Both Korea and Japan saw a relatively early development of functional water. There are numerous manufacturers of hydrogen water purifiers, such as Ioncares, Ionvida, Magiccos, and Paino. The producers of materials for alkali water and vitamins for dechlorination are also competitive.

(5) Key issues for selling home-use water purifiers in Korea

- About investing in production facilities

Korean manufacturers of components for home-use water purifiers are competitive. Handok and Altwell produce carbon blocks; Polymem, Toray, CSM, and Para manufacture UF filters; DM Fit, KQ, and McCoy offer push-in fittings for quick couplings. Korean vendors excel in design, production, assembly, and marketing. This, combined with high wages, makes it unlikely for new entrants to establish production facilities unless they opt for full automation.

2.Advice to New Brands Entering the Market:

The patriotism of Korean people is evident in their preference for Korean products. This allegiance may be subject to change. However, it will not be easy for any new brand to make inroads into this market.

Popular Brands in Korea:

Foreign Brands: Brita, Everpure, 3M, Laica, Culligan, BWT, Philips, Jet SodaStream (from Israel)

Domestic Brands: Pureal, Sejin Aqua, Waterpia, Claro, Ruhens, Hyundai, Wonbong, Filtertech, Wells, LG, OKwater, Coway, COMS, OKO, KC, ICEVAN, Cuckoo, SK Magic

India

11.1 Demographic Dividend

The average age of the Indian population is only 29. Those under 35 years old account for 65% of the population, while those over 65 years old make up only 5%. These figures highlight the demographic dividend in India.

11.2 Drinking Water Quality in India

Anyone who has been to India will know never to drink tap water. Even consuming fruits washed with tap water can lead to diarrhoea. Observing locals drinking water may make one wonder how they never fall ill.

A study by Water Aid, an international non-profit organisation, indicates that the quality of water in India is among the worst in the world. The Indian population is not immune to poor-quality water. Tens of millions of people fall ill each year from drinking contaminated water, and the number of child deaths caused by poor water quality reaches hundreds of thousands. The poor quality and scarcity of water in India naturally drive demand and attract ongoing investments from both public and private sectors, aiming to address this critical issue.

While everyone is aware of the water quality problem, not all consumers in India can afford water purifiers. Locals mainly rely on two methods: (1) drinking cooled water after it has been boiled, and (2) using simple tablets to purify water.

However, Indian companies have been collaborating in recent years with global leaders to gradually reduce the prices of water purification equipment. As a result, the penetration of water purifiers has increased in middle-class households. To address water scarcity, these purifiers are designed with large storage capacities to ensure consumers have water in case of supply disruptions.

A 2011 survey by the Commerce Development Research Institute on the demand for quality and competitively priced products in emerging markets suggests that about 65% of middle-class households in India have water purifiers or similar devices. The market for water purification equipment holds unlimited potential and business opportunities.

11.3 Growth and Forecasts of the Water Purifiers Market in India

According to the report “Forecasts and Opportunities for Global Water Purifiers: 2018”, the market size grew at a CAGR of approximately 10% from 2013 to 2018. Given its population and poor quality of drinking water, the Indian market is set to become the largest in the Asia Pacific region.

11.4 Market and forecasts for commercial-grade water purifiers market

The outlook for the commercial-grade water purifiers market is also optimistic. The report “Global Industrial Water Purifier Market 2017-2021” forecasts a CAGR of 5.68% for the market from 2017 to 2021. The Indian market is expected to show a CAGR of 25% over these five years, which is higher than the average global growth. The Indian market is set to become a significant market, second only to China.

11.5 Main products in the Indian market

There are three mainstream types of water purifiers in the Indian market:

- UV disinfection water purifiers

- RO water purifiers

- Chemical-based water purifiers

11.6 Tariffs on water purifiers in India

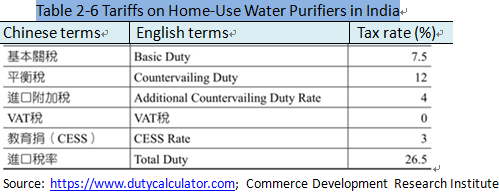

The Indian government imposes four duties on water purifiers, with a total tax rate of 26.5% (as detailed in the table below).

11.7 Certifications and Standards in the Indian Market

Each government typically sets its own standards for drinking water. The Indian government has formulated standards known as BIS Standards (BIS = Bureau of Indian Standards). The two popular inspection standards in India are NSF certificates and WQA gold seals.

11.8 Internet Penetration in India

The number of Internet users in India is the second largest in the world, following China’s 650 million. According to the 2019 Internet Trends Report, Internet coverage in India is 12%. India has the world’s second largest Internet population, after China (21% penetration).

11.9 Channels for the Purchase of Water Purifiers in India

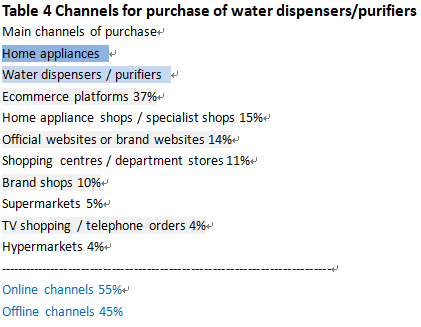

The results of the questionnaire survey below show that online shopping exceeds physical retail channels by 10% in the water purifiers market in India.

Sample for water dispensers / purifiers: Number of interviewers (744)

Q158: Where do you purchase water dispensers / purifiers? (select one option only)

Data source:

https://www.taiwanexcellence.org/upload/uploads/files/nelson/108_India_U&A.pdf#page30

11.10 Major e-commerce platforms in India:

UrbanClap, Infibeam, Infoedge, BookMyShow, Yatra

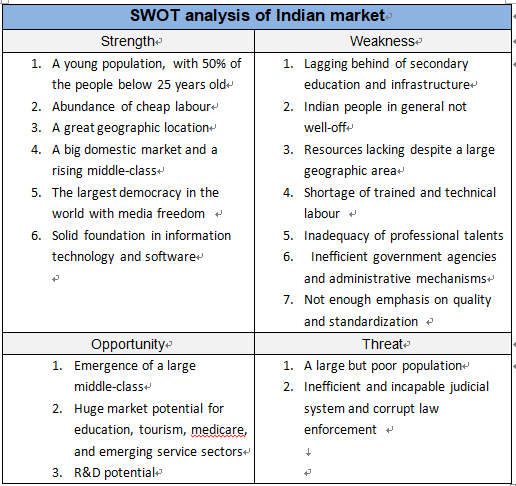

11.11 SWOT analysis of the Indian market for water purification equipment

11.12 Popular brands in India

Foreign brands: A.O. Smith, HUL PureIt (Unilever), Culligan

Domestic brands: Royal Aquafresh, TATA Swach, Eureka Forbes, AMPEREUS, KENT, Ruby, Lukzer, Grand Plus, Voltas, Butterfly, Prestige, Subtle Selection, Konquer TimeS, WaterScience, Watamate, Aqua Grand+, Generic, ORILEY, NAMIBIND, Konvio Neer, Eco365, Chirag, Elegant Casa, KRPLUS, AQUA DOVE, DE Fresh Aqua, Konka, Glassiano