The author has been working in the water purification industry for 35 years. As much as 90% of his business is exports to a total of 54 countries. He has travelled to 87 countries and about 45% of the time throughout the year he is on the road visiting clients; participating in tradeshows and marketing campaigns; understanding overseas markets; and attending meetings and conferences. The author stays on top of the water purification equipment market and trends in different countries and bring back water samples from all over the world for testing in Taiwan. The results are incorporated in the report and analysis of water quality in different countries. The author’s report and market analysis of 18 countries is freely available for downloads at https://ppt.cc/fzKJ2x.

When visiting different countries, the author explores various channels for the distribution of water purification equipment (such as department stores, hardware stores, consumer electronics shops, and chain stores for water purification equipment). He also visits clients in different countries. These clients include importers, wholesalers, retailers, and manufacturers of water purification equipment. The information obtained from discussions and business dealings with buyers around the world should ensure the objectivity of the market intelligence.

In this report, the author begins with an introduction to the 12 most prominent markets for water purification equipment. The discussion focuses on OEM/ODM players in the water purification equipment industry. This is followed by a detailed coverage and analysis of B2B companies. Objective recommendations are also provided to readers.

The main contents are as follows:

- Guidance on investments in these countries

- Purchasing from the appropriate markets

- Markets with the most competitive OEMs

- Recommendations for new brands entering these markets

- SWOT analysis for various markets

- Forecasts for 2020 and beyond

- Competitive OEM products in different markets

- Tips for conducting business in certain emerging markets

- Global mergers and acquisitions in the water purification equipment market

- Local and international brands active in different markets

I. Global Water Purifiers Market Size

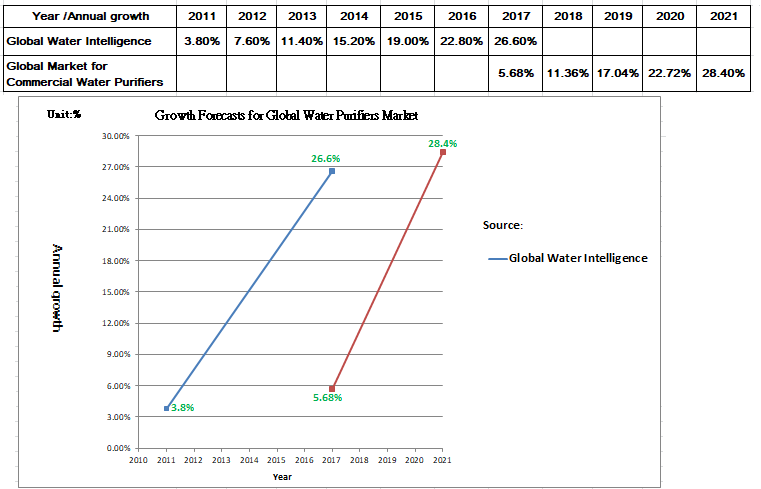

Numbers from UNICEF (the United Nations Children’s Fund) and the World Health Organization (WHO) suggest that approximately 663 million people worldwide lack access to clean drinking water. The safety and quality of drinking water are of utmost importance to both governments and the public. This is why there is increasing attention on water purifiers. According to the report “Global Water Purifiers: Forecasts and Opportunities for 2018,” the market size grew at a compound annual growth rate (CAGR) of around 10% between 2013 and 2018.

Meanwhile, the commercial market for water purifiers is also significant. The report “Global Industrial Water Purifier Market 2017-2021” forecasts a CAGR of 5.68% for the market during 2017-2021.

A survey by Global Water Intelligence estimated the global water resources market to be worth US$539 billion in 2013. It grew to US$586.3 billion by 2018, with a CAGR of 3.8% for 2011-2018.

These statistics indicate the ongoing and rapid growth of the water purification equipment market.

II. Global Supply Chain of Domestic Water Purifiers

Almost all the manufacturers in the global supply chain of water purification equipment are engaged in horizontal division of labour, aiming to achieve higher production efficiency and industry specialisation, to mitigate over-investments, and shorten development lead times. As long as 17 years ago, there were a few well-known and successful industry alliances in Taiwan. These alliances have made significant contributions to their respective industries in Taiwan. In addition to regular company visits, they also share knowledge on new products, new materials, and new technologies. They publish research findings and drive industrial upgrades across the value chain. The most successful alliance is the A-Team, part of the Taiwan Bicycle Association. It was the benchmark for all the industry alliances in Taiwan. The following is an analysis of the success of the A-Team.

In 2003, the founder of Giant and the founder of Merida proposed working together in response to the exodus of bicycle companies from Taiwan and the continued decline in exports. Industrial hollowing-out seemed like a real possibility. At that juncture, they invited 11 suppliers to establish A-Team, Taiwan Bike Association. The alliance introduced management tools such as TPS (Toyota Production System), TQM (Total Quality Management), and TPM (Total Productive Maintenance). Member companies visited each other to share insights. This co-competition model accelerated the industry’s growth as a whole.

The A-Team was formed when many bicycle companies in Taiwan relocated overseas. It was also a time when the global bicycle industry experienced a shrinking market size. However, under the leadership of the A-Team, the Taiwanese bicycle industry weathered the global financial crisis. A decade later, in 2014, the average selling price of exported bicycles was 306% higher than in 2003. During this period, the export value of bicycles increased by 295% and the export value of components rose by 363%. This has positioned Taiwan at the forefront of the global bicycle supply chain.

The water purification equipment industry in Taiwan established W-Team in 2015. It was initiated by Fluxtek and joined by over 10 companies across the domestic supply chain, from OEMs to ODMs. This has contributed to the gradual development of the supply chain, with the ambition of becoming the largest OEM country in the world. Member companies include manufacturers of parts and components such as booster pumps, transformers, plastic injection moulds, activated charcoal powder, filter cartridges, and seawater desalination.

Below is a snapshot of the supply chain distributions of competitive components and materials in the global water purification equipment industry:

1.Turkey: In-line filter cartridges, filter housings, plastic injection moulds

2.U.S.: Deleading agent, materials for heavy metal removal, reverse osmosis (RO) membranes, LED UV disinfection lamps

3.Iran: Polypropylene pleated (PP) filter cartridges

4.China: Reverse osmosis (RO) membranes, RO pressure tanks, PP filter cartridges, carbon block filters, booster pumps, quick couplings

5.Taiwan: RO pressure tanks, booster pumps, gooseneck taps, water separators and other non-ferrous metal components, electronic controls, quick couplings, LED UV disinfection lamps

6.Korea: Hollow fibre ultrafiltration (UF) membranes, vitamins (particularly for shower filters to remove chlorine), quick couplings

7.Japan: Calcium sulphite (particularly for shower filters to remove chlorine), activated carbon fibres, hollow fibre ultrafiltration (UF) membranes, electronic controls

III. Types of Domestic Water Purifiers

Residential water purifiers are divided into those for drinking water and those for non-drinking water.

1.Purifiers for drinking water

1.1. UV disinfection

The wavelength of UV disinfection lamps falls within the 250nm to 260nm range and provides excellent germicidal effects. This wavelength destroys chromosomes and facilitates photochemical reactions. The tubes of UV disinfection lamps are made of quartz glass. As the price of LED UV disinfection lamps continues to decrease, and given that their lifespan is longer than that of quartz glass and their design is more compact, LED disinfection lamps are expected to soon replace quartz glass UV disinfection lamps. Both types offer 99.99% bactericidal activity, making the treated water safe to drink.

- Hollow fibre ultrafiltration (UF) membranes

This type of filter works by forcing water through a semipermeable membrane, with a pore size of 0.02–0.1 µm.

3.Ceramic water filters

The filter operates as a siphon, typically made from diatomaceous earth with ceramic sintering. The filtration efficiency is high, while both production costs and energy consumption are low. The pore size of a ceramic filter is usually within 0.1 micrometres, which is sufficient to filter out bacteria and make water safe to drink.

Ceramic filters are used outdoors and are popular among mountain hikers. They are easily cleaned for repeated use.

4.RO (reverse osmosis) water filters

5.Purifiers for non-potable water

5.1 Water filter jugs

The filters are typically made of ion-exchange resins and activated carbon. Higher-quality ones use a low-sodium version of ion-exchange resins and silver-impregnated activated carbon (to inhibit the growth of bacteria).

5.2. Activated carbon water filters

They come in designs such as on-the-counter, under-the-sink, or at-the-tap. The filters are made with activated carbon.

5.3. Water Softeners

Water softeners typically utilise ion-exchange resins. The whole-house design employs positive ions (usually sodium) in the resins to exchange calcium and magnesium in the water for softening purposes. The exchange capacity of ion-exchange resins is limited. Once it nears saturation, it is necessary to use salt for regeneration to restore exchange capacity.

IV. OEM/ODM Qualifications and Characteristics in the Water Purifiers Market

There are few markets with qualified OEMs working for global brands. To secure orders from leading brands, OEMs and their local supply chains must possess the following capabilities:

- The supply chain for water purification equipment in the country should be comprehensive.

- This ensures prompt deliveries, prevents the rise of unit prices, and provides options for OEM suppliers.

- Quality of OEM products.

- Willingness and ability to undertake low-volume, high-variety orders.

- Prompt deliveries.

- Competitive prices.

- Respect and protection of intellectual property for products/services in the country and by local players.

Recommended reading: https://ppt.cc/fzKJ2x

V. Markets with Qualified OEM/ODMs for Domestic Water Purifiers

Currently, only the OEM/ODM companies in Taiwan, Korea, China, and Turkey meet all the above-mentioned six requirements.

Strengths of companies in Taiwan: water dispensers, water purifiers, completely built units (CBUs) of water purifiers, parts/components, LED UV disinfection lamps, smart panels, metal components processing, plastics and rubber moulding.

Strengths of companies in Korea: product design, RO membranes (from materials to finished goods), water dispensers, smart panels, plastic injection moulding.

Strengths of companies in China: RO membranes (reprocessing), water softeners, hollow fibre ultrafiltration (UF) membranes, metal components processing, smart panels.

Strengths of companies in Turkey: plastic filter flasks, filter cartridges, water purifier casings, booster pumps, RO machine assembly.

VI. Most Promising Markets for Water Purification Equipment

The following 12 markets are the largest for water purification equipment. They are either large in size, competitively priced, pioneers in technology, or have a comprehensive supply chain with government support. The author frequently visits these 12 countries and is well-acquainted with these markets.

Turkey

(1) Turkey as a Troubled Country

Newspapers and magazines are full of stories about the policy uncertainty of the Turkish government over recent years. Since the sovereignty adopted a presidential system, policy transparency and predictability have been reduced. This, combined with the dramatic depreciation of the Turkish lira and a high consumer price index, has weakened investor confidence. Both the current account and the financial account have been negative. The balance of foreign reserves has dropped, and foreign debts as a percentage of GDP have increased.

Although all news about Turkey is negative, the local market for water purifiers does not seem to be adversely affected by foreign debts, fiscal deficits, or COVID-19. An interesting data point is that Company A in Turkey has purchased a total of 175,080 RO pressure units from Taiwan from December 2019 to August 2020. The Turkish market for water purifiers still shows great potential.

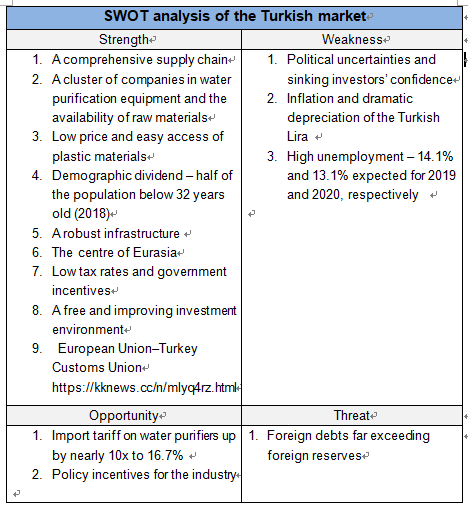

(2) SWOT Analysis of the Turkish Market for Water Purification Equipment

Below is a table for a SWOT analysis of the Turkish market for water purification equipment. The number of strengths is higher than the aggregate of weaknesses and threats. This suggests the rapid growth of the market for home-use water purifiers in Turkey.

(3) Key issues for entering the water purifiers market in Turkey

3.1 About investing in production facilities

Based on the aforementioned list of competitive advantages, the outlook for investment in production facilities remains positive. There is no control over foreign currencies. Capital movement is unrestricted. Turkey serves as a bridge between Europe and Asia, acting as a springboard into Central Asia, the Middle East, and North Africa. Turkey is a member of the European Union Customs Union, which facilitates entry into the European market. There is a cluster of supply chain companies in Turkey, so establishing production facilities will not be costly. This also ensures a timely market entry. Although prices are competitive, the demand for standard RO purifiers remains strong in Turkey. Investments may be made in this segment.

3.2 Advice to new brands entering the market

To protect domestic water purifier companies, the Turkish government has increased the import duty from 1.7% to 16.7%. With over 40 domestic brands in this market and considering consumers’ behaviour in the home-use sector, prices are the most significant consideration. There are also over 20 foreign brands in this crowded market. New entrants from overseas are advised to proceed with caution before entering the Turkish market.

(4) Popular brands in Turkey

Domestic brands: Hazar, ESLİ, Frizzlife, APEC, Express, Waterdrop, Simpure, Home Master, Brondell Circle, FS-TFC, Aquatic, Rinkmo, Geekpure, Hydro-Logic, PUCRT, Genuine, Yescom, AquaLutio, Watergeneral, Clear Choice, Global Water, Puroflo, Nakii, ZeroWater, LifeStraw, AquaBliss, Epic Pure, Fette, WINGSOL, Hskyhan, WATEN, HOSUN, AquaFresh, CLEAR2O, Aquagear, FROSTY H2O

Foreign brands: Brita, Whirlpool, RKIN, iSpring, Aquasana, Watts, AUGIENB, LYUMO, Brio, aibileec, Pur, CuZn, LEVOIT, Culligan, GE, LAKE, ESOW, Pure Source, Samsung, AO Smith