Introduction

I still remember the last time I wrote the article “2020 Global Household Water Purification Equipment Market Analysis and Forecast”; that was when Covid-19 began raging around the world. At that time, Taiwan managed to prevent the virus very well, and for the whole year, Taiwan’s residents were safe and at peace. However, in April 2021, an airline pilot contracted the virus, leading to community infections. During this period, about 200-300 Taiwanese people were confirmed to be infected every day. By 12 June 2021, the number of confirmed cases had reached 12,746, with 411 deaths; this placed immense pressure on Taiwan, which had been a role model in preventing the virus. It was then that I felt compelled to write this article to share my thoughts with you.

Reference: Formosa TV News

Covid-19 creates unexpected effects

As the virus continued to spread worldwide, many countries chose to lock down certain cities for safety. What we did not expect was the rise of the stay-at-home economy; working and studying from home created a surge in demand for notebooks. In 2020, for the first time ever, global notebook shipments exceeded 200 million units. The global transportation market was thrown into chaos due to the epidemic. Workers at container yards and piers became infected, leading to a lack of personnel to operate cranes, causing delays in loading and unloading, and disrupting flight schedules. Container turnover times increased, causing shipping fees to soar by 5-6 times. Despite the high prices, finding a container was still challenging. The quarantine period for Cathay Pacific pilots was extended from one week to two weeks, creating a shortage of pilots and reducing flights to the U.S., which in turn increased air shipment fees. This situation was entirely unexpected. For manufacturers, this created another significant problem: with clients unable to find containers for shipping, goods ready for dispatch had to be stored in factory warehouses.

Do material shortages and price increases result from Covid-19?

From crude oil, metal, grain, coffee, vegetables, to cement, all raw materials seem to be entering a “shortage era”. The pressure of rising material prices is evident, with increases in the prices of oil, gold, steel, grain, and petrochemicals. Everyone needs a moment to catch their breath. Moreover, due to Covid-19, countries locked down, and travel ceased. This led to a surge in sales of bicycles, sports equipment, outdoor gear, and clothing, with a new trend towards home shopping.

(1)Cardboard box shortage and price increases

The shortage of cardboard boxes is mainly due to the resurgence of Taiwan’s manufacturing economy and the impact of Covid-19, which increased online shopping orders and exports in various fields. The demand for cardboard boxes increased, but factories were unable to keep up with production. After the Council of Agriculture, Ministry of Economic Affairs, and PCAT reached a consensus with the top three paper manufacturers—YFY, Cheng Loong, and Longchen—they agreed to prioritise the production needs of fruits and vegetables. However, exporting companies now face difficulties, with finished products piling up and no cardboard boxes available for packaging.

(2)Steel prices reaching new highs

In 2023, the European Union’s introduction of a carbon border tax caused a significant shock. Consequently, China Steel must find ways to achieve carbon neutrality to benefit downstream industries. To achieve this, machinery and equipment upgrades are necessary, which will inevitably increase production costs. U.S. President Joe Biden proposed the “American Jobs Plan” with a total investment of USD $2.3 trillion, including electric vehicles, renewable energy, optical fibre, and semiconductors, as well as infrastructure expansion. These factors have contributed to the continuous rise in steel prices.

(3)Rising plastic material prices

In the Far East, the prices of the top five general-purpose resins have been increasing, with ABS, PS, and PVC reaching historic highs, and PE and PP hitting their highest points in the past 10 years. The water filter industry frequently uses plastic materials such as ABS, AS, PP, POM, and PC, all of which have seen price increases.

(4)Why is the price of copper soaring?

For the first time in 10 years, the price of copper has surpassed USD $10,000 per ton in London, consistently for three months. U.S. President Joe Biden’s infrastructure plan, which will impact the price of this critical material for green energy transformation, includes the use of copper in electric vehicles, solar energy, and wind energy. Meanwhile, China’s economy has recovered rapidly, and the construction and manufacturing industries remain strong, driving up copper prices.

Everyone is strengthening their equipment

With no opportunity to travel overseas to visit clients and with all expo fairs postponed, we see business owners using this time wisely to strengthen their internal capabilities. Whether by implementing automation or improving production processes to enhance quality, manufacturers of automation equipment are experiencing an overload of orders, with delivery times extending to at least six months.

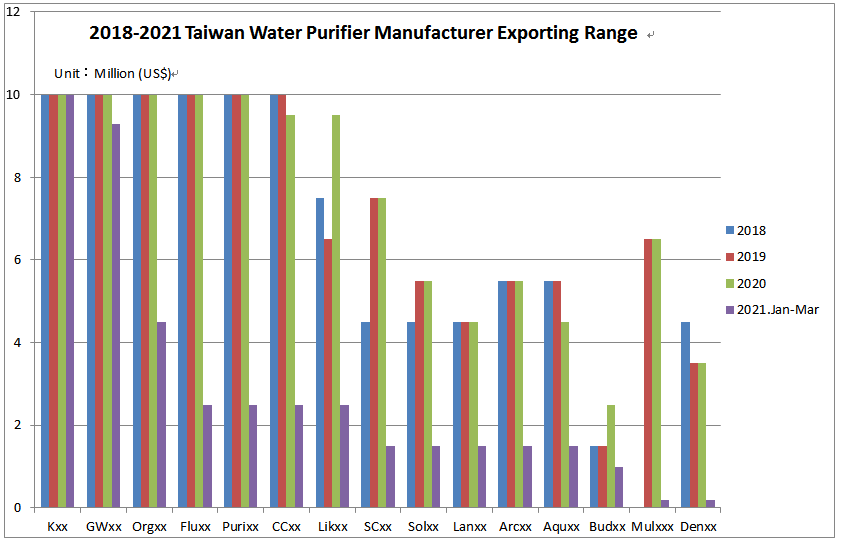

Exports are not affected

Covid-19 is spreading across Taiwan. While many sectors are affected by the virus, the export sector remains unaffected; in fact, it is thriving. This is particularly true for the bicycle and water filter industries.

Will it be an illusion about the growth?

Everyone seems eager to stock up on steel, copper, and plastic as the prices have increased so much, and also because everyone expects the prices to keep rising. Most companies in the water filter industry agree with this idea, so they are stocking up on materials or semi-finished products. It seems like everyone is full of orders and opening extra production lines, but it could end up being just an illusion. After Covid-19, will it be a problem for everyone to sell all these stocks?

Author: Rodger Lin, 12 June 2021

“Welcome reproduction, please indicate the source.”

Reference:

- CommonWealth Magazine

- United Daily News (Udn)

- Commercial Times (ctee)

- Council of Agriculture (COA)